It’s not just Trump: Economic malaise and political chaos are battering Europe’s currency too

Home-grown problems are hurting the single currency, and the markets are looking to the ECB for a remedy.

Europe’s politics are a mess, the economy is stalling — and its currency is taking the strain.

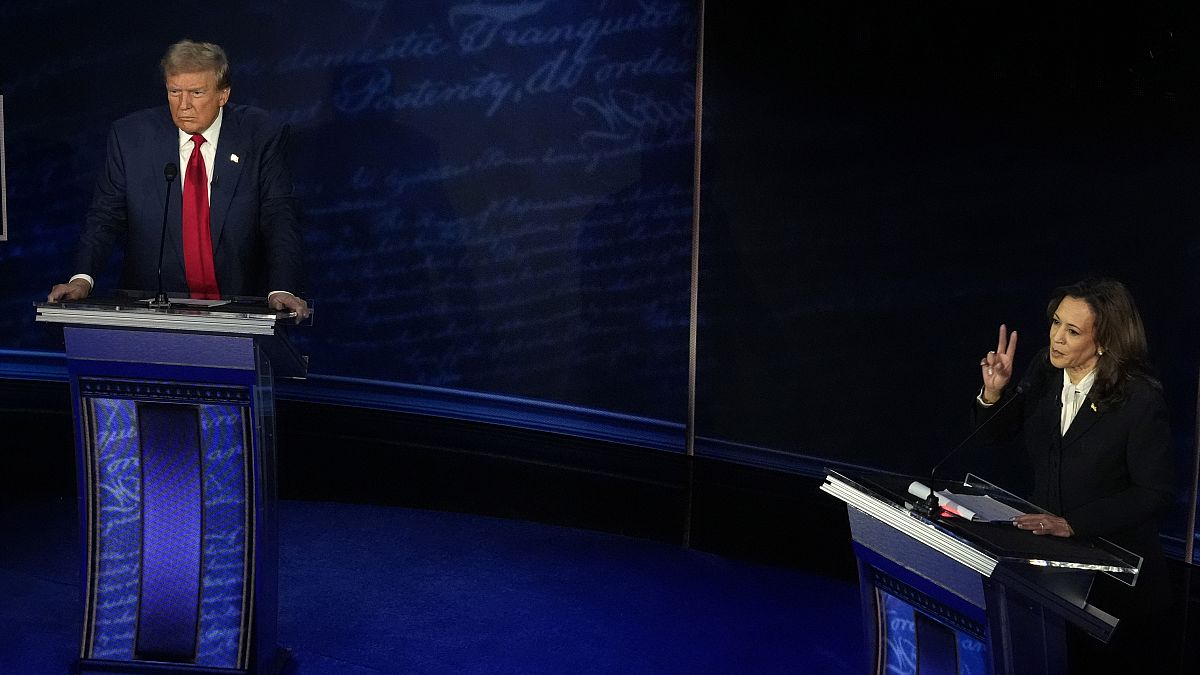

The euro has fallen to its lowest level against the dollar in nearly two years. But while the election of Donald Trump as U.S. president and the anticipation of his policies have played a big role in that weakness, a succession of bad political and economic news from the region’s two biggest countries has sapped confidence as well.

In France, right-wing firebrand Marine Le Pen is threatening to bring down Prime Minister Michel Barnier’s government for having the temerity to remove electricity subsidies. In Germany, as Olaf Scholz’s lame-duck administration waddles toward early elections in February, industrial stalwarts such as Volkswagen, Robert Bosch, Schaeffler and Thyssen-Krupp are lining up to cut thousands of jobs.

The European Central Bank, meanwhile, reminded markets last week that the combination of low growth and high budget deficits could revive fears of national bankruptcies across the eurozone.

‘Parity is the next milestone’

The single currency fell as low as $1.033 against the dollar on Friday, after dismal economic data sparked expectations that the European Central Bank will have to accelerate interest rate cuts. Those forecasts had markets pricing a 50 percent chance of a 0.5 percentage point cut in December; while the euro has recovered a little since then, analysts say it may be heading back toward parity with the greenback, anticipating fresh blows from Trump’s expected tariffs.

“Absent a growth turnaround in Europe, parity is the next milestone,” said Oxford Economics senior economist Daniel Kral. As things stand, said ING’s head of FX strategy Chris Turner, it could get “very close to parity before year-end.”

This would be only the third time since the single currency was launched that it buys no more than a dollar. The first moment came in the early 2000s, when the euro was still establishing its international credibility. The second was in 2022, when Europe suffered an energy price surge attendant on the war in Ukraine.

To be sure, the Trump factor is powerful: Since his Nov. 5 victory, the dollar has gained across the board as markets have priced in expectations not just of a trade war, but also of corporate tax cuts and a tighter labor market due to a clampdown on illegal immigration. Forex experts at Brown Brothers Harriman point out that with the U.S. economy still in a sweet spot and a boost in fiscal spending under Trump likely, the Federal Reserve will have to keep U.S. interest rates higher for longer than previously thought.

Problems at home

But the euro’s home-grown problems have ensured it has lost more than its peers. It’s down 4 percent since the election, while the dollar index, which tracks the greenback against a basket of developed market currencies, is only up 3.4 percent.

A foretaste of what may soon be in store for Europe came overnight, as the president-elect announced his intention to impose a 25 percent tariff on all imports from Canada and Mexico as soon as he takes office, alongside a separate 10 percent tariff on imports from China. The news sent the Canadian dollar to a four-year low and pushed the Mexican peso 1 percent lower, almost to the two-year low it hit earlier this month.

The common thread running through the three parity episodes has been German economic weakness: In 2000, as today, Germany was considered the sick man of Europe, while two years ago it was Germany that suffered most from the loss of cheap Russian energy and the Russian export market. In recent weeks the euro has underperformed not only against the dollar but also against sterling (where it is also flirting with a two-year low) and the Swiss franc.

With national budgets already stretched to the limit, it means that — once again — the ECB is likely to be the only game in town.

“The view here remains [that] there is no fiscal cavalry coming in the eurozone and that the only way to address the current malaise is for the European Central Bank to cut rates more quickly than usual,” ING’s Turner wrote in a note to clients.

Fed-ECB rate gap could widen

In an interview published on Monday, ECB chief economist Philip Lane stressed that in the eurozone, “monetary policy should not remain restrictive for too long,” as “otherwise, the economy will not grow sufficiently and inflation will … fall below the target.”

By contrast, New York Fed President John Williams said the U.S. is “not quite there yet” on inflation and signaled only a gradual relaxation of policy next year.

As a result, the gap between Fed interest rates, currently at 4.50-4.75 percent, and the ECB’s benchmark, currently at 3.25 percent, could widen further next year. Comparatively higher interest rates in the U.S. make the dollar a more attractive currency to hold, pushing investors out of the euro and into the dollar. This might not please European holidaymakers, but analysts say it could be what the bloc’s economy needs to get back on its feet.

“All [the eurozone] needs is a lower euro and markets will take care of the rest,” said Robin Brooks, senior fellow at the Brookings Institution, on X. “[The] euro in 2022 went below parity and should never have gone back above. Markets are now fixing that mistake.”

Turner, however, warned that by forcing the euro lower, markets could take away with one hand what they give with the other.

“If the reason why the euro is lower is the prevailing pessimism in Europe,” he warned, “it can drive up borrowing costs because of the risk premium associated with eurozone assets.”

What's Your Reaction?